Checking Account Marketing Critical Data Trends in the Last 6 Months

June 11, 2024 by Tim Whitley

Introduction

In the rapidly evolving world of digital banking, understanding the customer journey is essential for financial institutions aiming to stay ahead. Our latest insights reveal significant shifts in how potential customers are researching and engaging with checking accounts online. By analyzing data from January 1, 2024, to April 30, 2024, and comparing it to the same period in 2023, we can pinpoint critical trends and their implications for marketing strategies.

Short on Time?

Get this Customer Journey research, bundled with all of our other customer journey research papers, emailed to you each in an easy-to-read PDF format. You’ll also be notified when we release upcoming research papers scheduled later this year.

- Easy-to-read PDF format

- All other Customer Journeys bundled in one email

- Updates when new Customer Journeys are published

Get the PDF versions of all customer journeys!

Please allow up to 2 business days.

Methodology

As a Google Premier Partner, Google provides mhp.si with exclusive data that gives us deep insights into these fields.

First, let’s define the key performance metrics extracted from Google’s search index:

- Queries: Only total searches conducted by users related ONLY to Checking Accounts.

- Ad Depth: The number of ads shown per search query.

- Impressions: The frequency of ad displays in response to these queries.

- Clicks: The number of times users engaged with ads or organic search results.

All data provided is pulled from the Checking Account search terms when a user searches for a new checking account. It is also a Year-Over-Year (YoY) analysis showcasing how the customer journey/customer experience changed in 12 months.

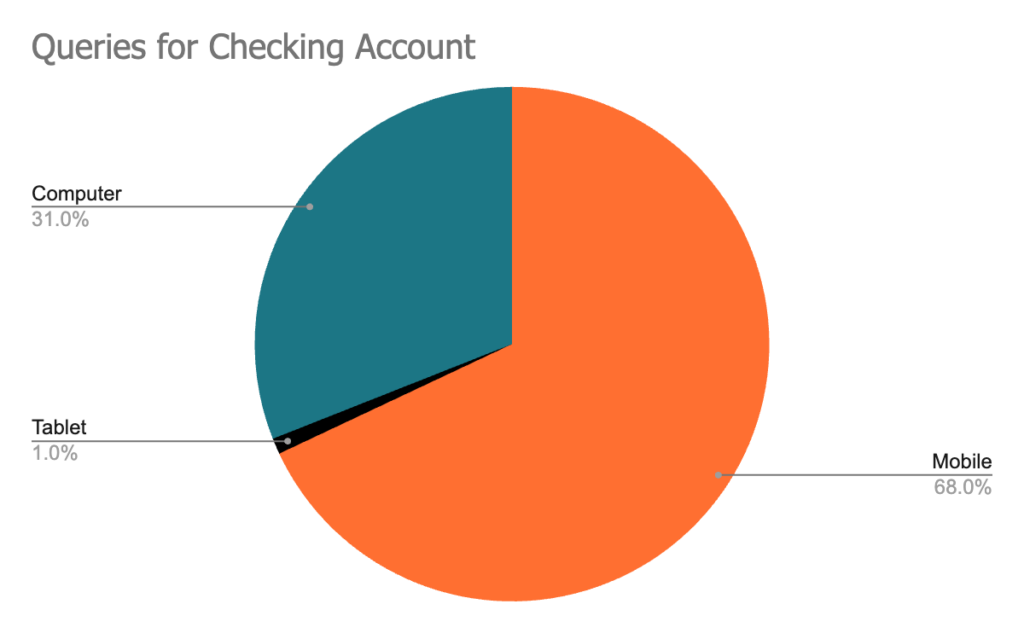

📱Mobile Searches Continue to Dominate

Mobile devices remain the primary gateway for checking account searches,

Growth in Search Activity Across Devices

- Overall Search Growth: There was an 11% increase in search queries for checking accounts.

- Device-Specific Trends:

Mobile: Searches grew by

16%, reinforcing the need for robust mobile marketing strategies.

Computers: A modest

3% increase in search activity, but notable for its 26% share of all clicks.

Impressions and Clicks Show Diverging Trends

Impressions: The total number of ad impressions decreased by

Clicks: There was a significant

Competitive Landscape and Ad Depth

- Ad Depth: The overall ad depth (the number of ads shown per search) ⬇️ decreased by 3%. This reduction in competition allows advertisers to capture a larger share of the audience with fewer competitors in the ad space.

- Device-Specific Ad Depth:

- 📱Mobile and Tablets: Both saw a ⬇️ 5% decrease in ad depth, showing reduced competition.

🖥️ Computers: Experienced a slight ⬆️ 1% increase in ad depth, indicating a stable competitive environment.

Seasonal Patterns and Cost Per Click (CPC)

- Seasonality: The data shows consistent peaks in search activity during March over the past four years, with the highest CPCs occurring in November. This trend suggests that banks should allocate more budget to their digital campaigns in these peak months to maximize visibility and engagement.

CPC Trends: Cost per click has ranged between $7.40 and $9.25, with significant peaks in late fall. Understanding these patterns can help in planning more cost-effective ad campaigns.

Implications for Marketing Strategies

Given these trends, here are some actionable recommendations for financial institutions looking to optimize their digital marketing efforts:

- 📱Mobile-First Approach: With most searches and clicks occurring on mobile devices, ensuring a seamless and responsive mobile experience is paramount. This includes mobile-optimized websites and applications that facilitate easy account-opening processes.

- Year-Round Campaigns: Since there is no distinct seasonal pattern apart from the March peak, maintaining consistent marketing efforts throughout the year is essential. Adjusting budgets to capitalize on periods of increased search activity, like March and November, can enhance campaign effectiveness.

- Enhanced Ad Relevance: With decreased ad depth, creating highly relevant and engaging ad content is more critical than ever. Focus on delivering tailored messages that address potential customers’ pain points and provide clear, compelling calls to action.

- Leveraging Data Analytics: Utilize analytics to continuously monitor and adapt to consumer behavior patterns. This data-driven approach can help refine marketing strategies and improve ROI.

By staying attuned to these trends and adjusting strategies accordingly, financial institutions can better navigate the digital landscape and effectively engage potential customers in their journey to finding the perfect checking account.

About mhp.si banking

mhp.si has emerged as a “game changer” in banking and financial services. As a Google Premier Partner, we can develop a results-focused performance marketing mix to promote banking and financial products to the right customers with measurable ROI.

We seamlessly integrate traditional and digital marketing techniques to reach your potential customers where they live, work, and play. We use an FLA-compliant, data-driven approach to create personas, find the correct target audience, and leverage the proper channels.

mhp.si tailors our banking and financial marketing efforts to grow our client’s digital presence through content marketing, search engine marketing, and optimization.

We target your message online, on smartphones, on Connected TV, and on HHID addresses by reaching customers at the household level. This allows us to meet customers at every stage of life with high intent to procure banking products and services. We put you in the right place at the right time.