Banking and Finance Case Study

Background

Banks and financial institutions are vital members of our communities, unlocking doors and pathways for individuals and business owners, but not everyone knows about the service products available to them.

Data-driven marketing strategies can help banks build stronger communities and through it all, the client needed a marketing partner that knew how to work with Fair Lending Act (FLA) compliant strategies. That’s where mhp.si comes in.

The Challenge

Our client, one of the largest credit unions in the Mid-South, wanted to increase their mortgage loan, HELOC loan, credit card, premium checking, auto loan, business checking and SBA loans applications, while driving brand awareness for residents in two specific geographies.

The Strategy

Doppio®, our system pairing aggregated and automated data with the insights and instincts of our certified team, gives our TraDigital™ team access to 381 FLA-Compliant data layers, which we use to leverage impactful data and devise measurable, omnichannel marketing plans. Our team developed a performance marketing mix for the client including paid search, Meta advertising, display, retargeting and connected TV tactics to generate qualified leads.

As a Google Premier Partner, a distinction given to the top 3% of marketing agencies in the U.S., we have access to cutting-edge data tables and audience reports, which further informs our strategies and industry standards. Through our proven blend of strategy, performance and results, we hurdle those standards with ease.

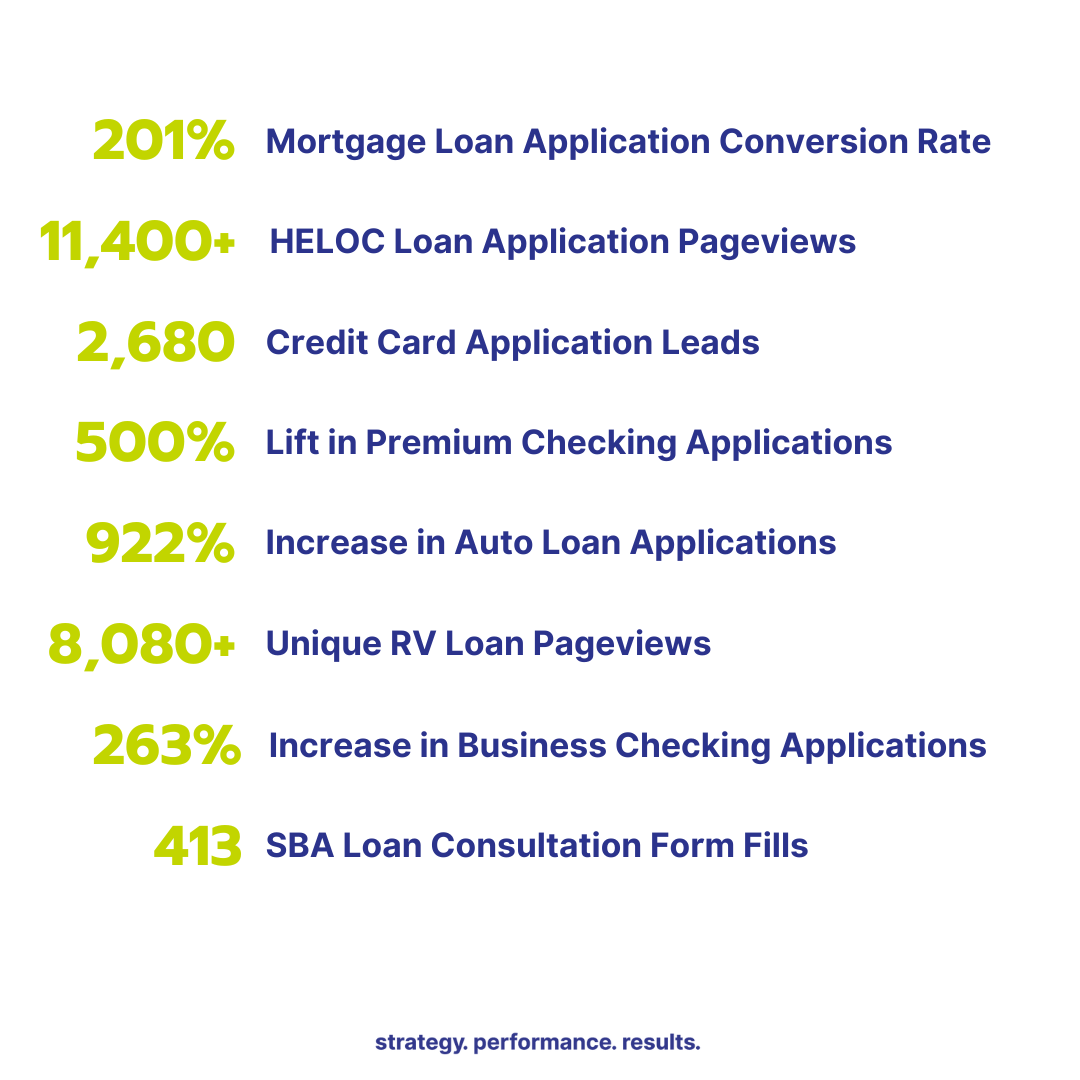

The Results

Over 3, 6 and 9-month campaigns, our team garnered the following results.

Other Success Stories

Auto Loans Case Study

RV Loans Case Study

HELOC Case Study

Mortgage Loans Case Study

SBA Loans Case Study

Student Checking Case Study

Premium Checking Case Study

Credit Card Case Study

Business Checking Case Study

Healthcare Search Engine Optimization Study

People Searching for a Checking Account Between January 1 and April 30, 2024

People Searching for HELOC in 2023

People Searching for Commercial Lending in 2023

People Searching for a Checking Account in 2023

Mortgage Loan Case Study

Neurolens Case Study

Hospital Marketing Case Study

Influencer Marketing Case Study

G2B Marketing Case Study

Tourism Marketing Case Study

Automotive Marketing Case Study

Hospitality Marketing Case Study

Telecom Marketing Case Study

Personal Injury Lawyer Marketing Case Study